The Group monitors performance against the following key performance indicators:

• Football success

• Match attendance statistics

• Sales performance per division

• Wage and other costs

• Capital expenditure

• Profit and cash generation

As last year let’s look at each in turn.

• Football success

As last year second in a two horse race is still last.

• Match attendance statistics

Season ticket sales now down to 42,500 with £13.6m compared to 2009/2010 48,000 resulting in £16m income. Looking closer the average ticket sales has dropped from £333 to £320 probably being less full adult tickets and more child tickets. It is only two years since season ticket numbers were 54,252 and at this rate you could be looking at 36,000 next year.

It is not the case people are buying individual match day tickets rather than season tickets as match ticket sales of over 166,000 generated an income of over £3.5m, which included three domestic cup-ties contested against Rangers compared to 240,000 for 2009/2010 generating revenue in excess of £6.5m AND Europe gave us a further 210,000 ticket sales at £4.7m.

So looks like the poor product on the park is just turning people off rather than people picking and choosing games.

• Sales performance per division

Merchandising down for a second year to £14.33m or 7.5% from £15.5m which was down 9.8% from the previous year.

Multimedia down 32.4% to £7.24m from £10.71m which was down 43% from £18.87m.

Let’s look at that again. In two years down 62%. How many companies would allow a division to fall 62% in two years? Not many I’d guess. Less so when the whole digital social media world is evolving.

• Wage and other costs

Wages down to £32.66m from £36.48m. At last some costs going down however the quality of what we are watching leads you to conclude you get what you pay for although with Mr Whyte making the point Rangers went out of Europe firstly to a team with a £5m wage bill and secondly to a team with £1.5m payroll you’ve got to wonder.

On closer inspection we have 89 full time staff compared to 101 in 2009/2010. The average full time to total payroll cost has actually increased to £366,966 from £361,217.

• Capital expenditure

The additions to property, plant and equipment in the period of £0.90m are represented mainly by the Jock Stein statue, work on the new pitch at Lennoxtown, additional sports science gym equipment, safety improvements to the stadium, new multi-media and scouting offices and further enhancements to information technology equipment.

Last year we spent a similar £1m.

So nothing to see here move-on.

• Profit and cash generation

Come on there must be some good news somewhere.

Year-end net bank debt of £0.53m (2010: £5.85m).

Profit before taxation of £0.10m (2010: £2.13m loss).

Operating expenses before exceptional items £52.50m (2010: £57.25m).

Profit from trading before asset transactions and exceptional items of

£56,000 (2010: £4.46m).

Exceptional costs of £3.99m (2010: £3.14m)

So the board failed their own key performance indicators and Mr Reid will set off into the sunshine leaving behind not very much.

On to the bit we have all being waiting for:

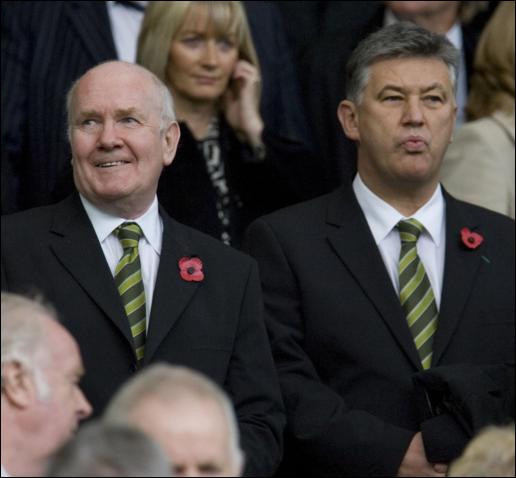

Peter T. Lawwell (52), Chief Executive, joined the Company in October 2003 from his position as commercial director with Clydeport plc. Previously he held senior positions with ICI, Hoffman-La-Roche and Scottish Coal.

I have previously on this site bemoaned the Chief Executives bonus. The accounts are now online and we see the remuneration for the year increased from £753,193 to £802,200. Mr Lawwell participates in the Long Term Incentive Plan (LTIP). The main objective is to retain and reward key executives. Having met performance criteria imposed by the board and remaining for a period of 4 years the award will be met. The Board acting through the remuneration committee sets the conditions. Although not stated they are said to be “challenging but achievable” with both personal and corporate performance elements. All very laudable for medium term stability however you will have noticed that there is no detail to these challenging but achievable touchy feely targets.

Mr Lawwell also participates in the annual performance related bonus scheme. Unlike the LTIP we do have some targets defined this time:

Improving and sustaining the financial performance of the group from year to year

Delivering and enhancing shareholder value

Enhancing the reputation and standing of Celtic

Delivering consistently high standards of service to Celtic and its customers

Attracting and retaining and monitoring talented individuals.

For the financial year to 30 June 2011, Mr Lawwell continued to be entitled to a maximum payment under the Company’s bonus scheme of 60% of basic salary, if all performance conditions were satisfied, but this is subject to an overall maximum of £200,000, notwithstanding the increase in his basic salary that took place in 2008. Mr Lawwell’s maximum participation in the LTIP is subject to the conditions of that scheme. Subject to the outcome of the LTIP, an additional loyalty award of £150,000 was payable to Mr Lawwell if he remained employed by the Company throughout the period from 15 September 2008 to 30 June 2011. The amount (if any) of the loyalty award was dependent upon the outcome of the LTIP but the aggregate of payments due under the loyalty award and LTIP could not exceed £650,000. As Mr Lawwell’s total LTIP entitlement, subject to satisfaction of the scheme terms and conditions, is £650,000, no additional loyalty award is payable. Mr Lawwell deferred payment of an element (£152,288) of his bonus for financial year 2009/10 for an unspecified period. He has deferred payment of his entire bonus award for 2010/11 (£200,000) on a similar basis. Both deferred amounts remain payable at Mr Lawwell’s instance.

Peter Lawwell and Eric Riley participate in the LTIP. The Remuneration Committee was satisfied that each of these individuals had satisfied the applicable criteria for the financial year to 30 June 2011. Accordingly, the awards set out in the table below have been made conditionally for the benefit of Mr. Lawwell and Mr. Riley, respectively for the 2010/11 financial year. Subject to Mr Lawwell and Mr Riley being employed at the time, payment of their accumulated LTIP interest will be released at the end of August 2011.

P Lawwell £650,000 4 financial years to 30 June 2011

E Riley £250,000 4 financial years to 30 June 2011

So there we have it. The board have failed almost every target they set themselves yet three weeks ago Messrs Lawwell and Riley split £900,000.

Mr Lawwell does make the following statement:

“Results on the pitch continue to be the major influence on trading performance”

Well it’s good to know our remuneration package isn’t wasted and he’s grasped the reason why we are all here.

Trying telling the 7,500 sitting in the Broomloan Stand on Sunday watching an alleged worst Rangers team in memory hammer us what you are doing to improve the results on the pitch. If they are the worst just what does that say of us?

(I think we need a Celtic Revival Plan – Harry Brady!)