Mr Lawwell also participates in the annual performance related bonus scheme. Unlike the LTIP we do have some targets defined this time:

- Improving and sustaining the financial performance of the group from year to year

- Delivering and enhancing shareholder value

- Enhancing the reputation and standing of Celtic

- Delivering consistently high standards of service to Celtic and its customers

- Attracting and retaining and monitoring talented individuals.

Mr Lawwell was entitled to £190,359 under this bonus scheme although magnanimously and for no apparent reason waived £38,071. This 20% waived is for 20% less points than last season (incredibly we finished just one point worse off)? 20% further behind Rangers? 20% reduction in quality of playing staff? You can guess.

The Directors’ report confirms that the company monitors performance against the following key performance indicators:

- Football success

- Match attendance statistics

- Sales performance per division

- Wage and other costs

- Capital expenditure

- Profit and cash generation.

Looking at the Company performance monitors as the LTIP criteria is not specified.

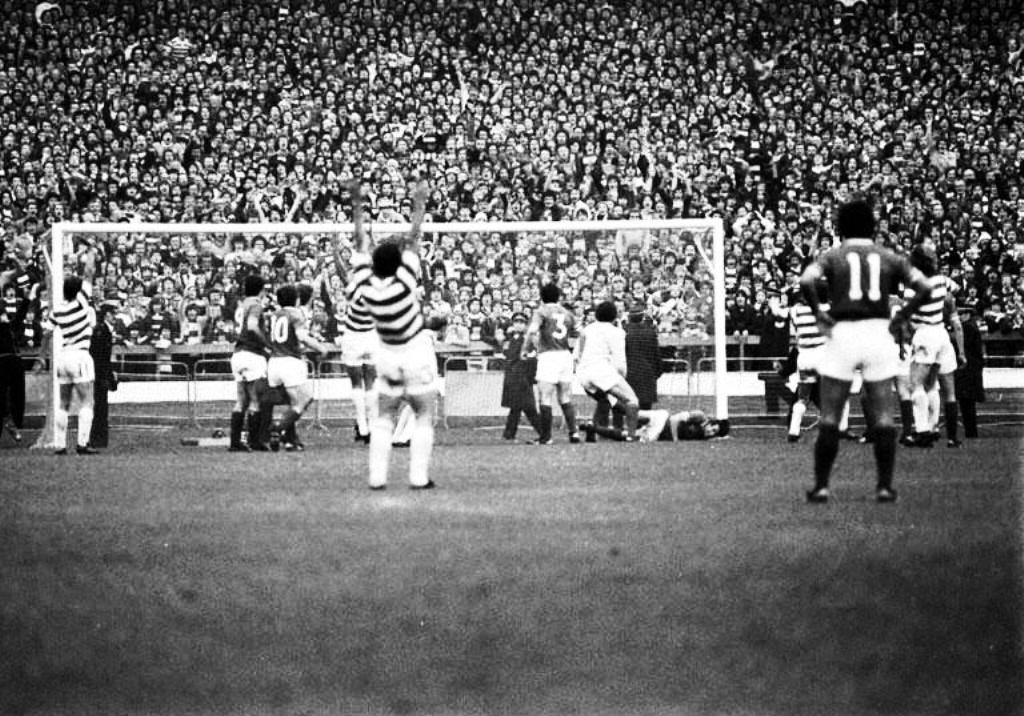

- Football success

Well I don’t think anyone could consider second in a two horse race a success

- Match attendance statistics

Average home league attendance down from 57,750 to 53,288 and the lowest for 5 years

Season tickets down from 54,252 to 50,826 and the lowest for 5 years

- Sales performance per division

Merchandising revenue down 9.8%.

Catering and Corporate. Although no figures for this in the Chief Executives report the phrase “particularly challenging” would lead one to suspect down.

Partner Programme also described as “a tough economic environment” read into that what you wish however this is the Tennents deal, which has been widely discussed.

- Wage and other costs

A success!! Expenses down by £4.1m to £57.25m and wages down by £2.27m to £36.48m. Well success is debatable. The head count reduced from 508 to 454 so the average wage bill actually went up.

- Capital expenditure

Negligible and barely moved for 5 years

- Profit and cash generation

Turnover reduced by £10.87m or 15% to £61.72m

Profit from trading reduced from £11.23m to £4.46m

All things are relative and perhaps Mr Lawwell is paid the going rate. To allow comparison I have looked at the 2010 accounts of Scottish Power. A high profile Scottish based company although I’m sure no one could name the Chief Executive (its Nick Horler).

2010 figures:

|

|

Celtic |

Scottish Power |

S.P. Factor over Celtic |

|

Turnover |

£61.72m |

£5,300m |

86 |

|

Loss |

£2.13m |

£760.6m |

n/a |

|

Staff |

454 |

10,000 |

22 |

|

Chief Executive

|

Salary £507,625, Bonus £152,288, Benefits in kind £17,1326 Pension £76,144 Total £753,193 |

Salary £508,500, Bonus £266,700, Benefits in kind £26,800

Total £802,000 |

1.06 |

On this comparison he is more than handsomely paid the only comparison of the companies being the salary paid to the respective Chief Executives. Little wonder he sees his salary as off limits on his meet the punter tour.

I could give my opinion on the current playing squad however it is only my opinion that we have a squad of mediocrity and the new signings are no better than the ones we had. It is criminal that we have not replaced McManus and Caldwell with anything better. Looking through the spine of the team we have a loan goalkeeper, perhaps one centre back although slow as slow and the rest still cannot displace Loovens. Brown still Brown and Kayal and Ledley had their worst games for us on Sunday. Murphy slow and in my opinion no better than Samaras.

However my opinion is just that, my opinion.

The facts regarding Mr Lawwell, his performance and his remuneration are facts.

The company sets 7 performance criteria. All 7 have not been met yet this is deemed adequate to trigger a bonus.

The remuneration was off limits at the punters tour.

Hopefully Mr Lawwell, and those that determine performance and remuneration, will not escape scrutiny at the forthcoming AGM.